March 16, 2019

Financial exclusion and systemic vulnerability are the risks of cashlessness

"Access to Cash Review" confirms much that we have been warning of as UK walks into its future financial gridlock. From WolfStreet:

Transition to Cashless Society Could Lead to Financial Exclusion and System Vulnerability, Study Warnsby Don Quijones • Mar 14, 2019

“Serious risks of sleepwalking into a cashless society before we’re ready – not just to individuals, but to society.”

Ten years ago, six out of every ten transactions in the UK were done in cash. Now it’s just three in ten. And in fifteen years’ time, it could be as low as one in ten, reports the final edition of the Access to Cash Review. Commissioned as a response to the rapid decline in cash use in the UK and funded by LINK, the UK’s largest cash network, the review concludes that the UK is not nearly ready to go fully cashless, with an estimated 17% of the population – over 8 million adults – projected to struggle to cope if it did.

Although the amount of cash in circulation in the UK has surged in the last 10 years from £40 billion to £70 billion and British people as a whole continue to value it, with 97% of them still carrying cash on their person and another 85% keeping some cash at home, most current trends — in particular those of a technological and generational bent — are not in physical money’s favor:

Over the last 10 years, cash payments have dropped from 63% of all payments to 34%. UK Finance, the industry association for banks and payment providers, forecasts that cash will fall to 16% of payments by 2027.

...

Curiously, several factors are identified which speak to current politics:

- "ATMs — or cashpoint machines, as they’re termed locally — are disappearing at a rate of around 300 per month, leaving consumers in rural areas struggling to access cash."

- "The elderly are widely perceived as the most reliant on cash, but the authors of the report found that poverty, not age, is the biggest determinant of cash dependency."

- "17% of the UK population – over 8 million adults – would struggle to cope in a cashless society."

- "Even now, there’s not enough cash in all the right places to keep a cash economy working for long if digital or power connections go down, warns the report."

I have always thought that Brexit was not a vote against Europe but a vote against London. The population of Britain split, somewhere around 2008 crisis into rich London and poor Britain. After the crash, London got a bailout and the poor got poorer.

By 2016-2017 the feeling in the countryside was palpably different to London. Even 100km out, people were angry. Lots of people living without the decent jobs, and no understanding as to why the good times had not come back again after the long dark winter.

Of course the immigrants got blamed. And it was all too easy to believe the silver-toungued lie of Londoners that EU regulation was the villain.

But London is bank territory. That massive bailout kept it afloat, and on to bigger and better things. E.g., a third of all European fintech startups are in London, and that only makes sense because the goal of a fintech is to be sold to ... a bank.

Meanwhile, the banks and the regulators have been running a decade long policy on financial exclusion:

"And it’s not all going in the right direction – tighter security requirements for Know Your Customer (KYC) and Anti-Money Laundering) (AML), for example, actually make digital even harder to use for some.

Note the politically cautious understatement: KYC/AML excludes millions from digital payments. The AML/KYC system as designed gives the banks the leeway to cut out all low end unprofitable accounts by raising barriers to entry and by giving them carte blanche to close at any time. Onboarding costs are made very high by KYC, and 'suspicion' is mandated by AML: there is no downside for the banks if they are suspicious early and often, and serious risk of huge fines if they miss one.

Moving to a cashless, exclusionary society is designed for London's big banks, but risks society in the process. Around the world, the British are the most slavish in implementing this system, and thus denying millions access to bank accounts.

And therefore jobs, trade, finance, society. Growth comes from new business and new bank accounts, not existing ones. Placing the UK banks as the gatekeepers to growth is thus a leading cause of why Britain-outside-London is in a secular depression.

Step by painful step we arrive at Brexit. Which the report wrote about, albeit in roundabout terms:

Government, regulators and the industry must make digital inclusion in payments a priority, ensuring that solutions are designed not just for the 80%, but for 100% of society.

But one does not keep ones job in London by stating a truth disagreeable to the banks or regulators.

November 07, 2016

Senegal to use eCurrencyMint for digital cash

Disclosure - I audited eCM as part of their fundraising process a few years back. Very happy to see them finally announcing their success, and hope there is more to come!

Senegal to get bank-backed digital currency

04 November 2016 Source: eCurrency Mint

eCurrency Mint Limited (eCurrency) announced today that it has partnered with Banque Régionale de Marchés (BRM) to provide a digital currency in the West African Economic and Monetary Union (WAEMU). BRM will issue the digital tender, eCFA, in compliance with e-money regulations of Banque Centrale des Etats de l’Afrique de l’Ouest (BCEAO), the Central Bank of WAEMU. This secure digital instrument can be transacted across all existing payment platforms and will be equivalent in value to physical legal tender.

BRM announced the eCFA distribution will begin in Senegal and will be extended in a second phase to Cote d’Ivoire, Benin, Burkina Faso, Mali, Niger, Togo and Guinea-Bissau. The eCFA is a high security digital instrument that can be held in all mobile money and e-money wallets. It will secure universal liquidity, enable interoperability, and provide transparency to the entire digital ecosystem in WAEMU.

“The mission of eCurrency is to preserve the secure and inclusive characteristics of physical fiat currency in our rapidly emerging digital world. We are realizing this important mission in the WAEMU region through the implementation of eCFA by BRM,” said Jonathan Dharmapalan, Founder and CEO of eCurrency.

With only 20% of Africa’s population having access to basic banking services, a trusted electronic means of transacting is the ultimate instrument of financial inclusion. The evolution to an electronic digital legal tender offers citizens a means by which to save and transact in a secure digital instrument. The eCFA is issued to coexist with other forms of currency, offering a digital form to seamlessly send, receive, store, and transact digitally.

“We are committed to bringing digital financial services and true financial inclusion to West Africa,” said Alioune Camara, CEO of BRM. “We are very happy to announce the eCFA capability here. An eCFA backed by our banking system and the central bank is the safest and most secure way to enable the digital economy. We can now facilitate full interoperability between all e-money payment systems. This is a great leap forward for Africa.”

The electronic money provided by BRM can only be issued by an authorized financial institution. It uses high security cryptographic protocols to ensure that it cannot be counterfeited or compromised. Because it is interoperable and it provides transparency it promotes governance and regulation by the central bank.

June 17, 2015

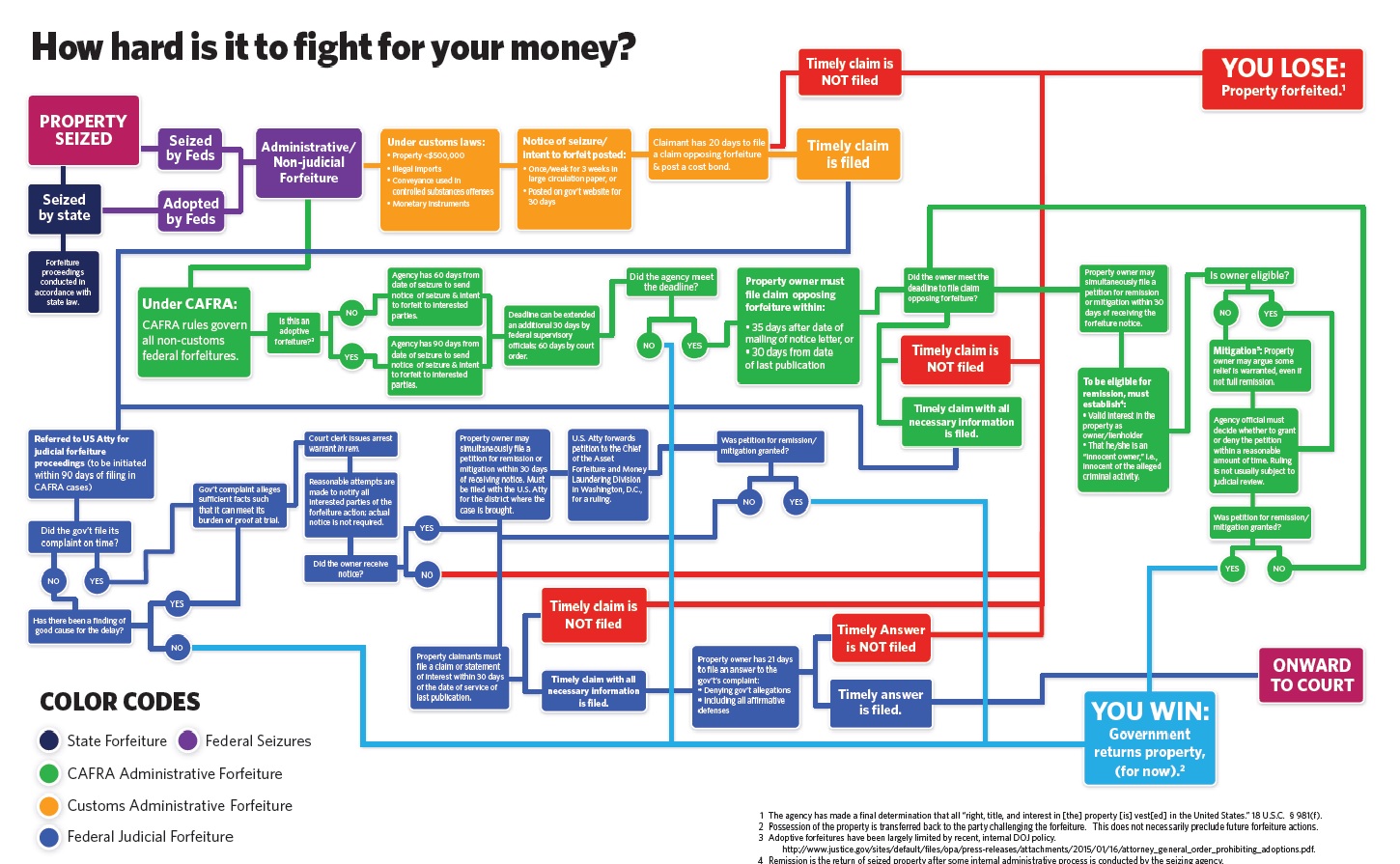

Cash seizure is a thing - maybe this picture will convince you

There are many many people who do not believe that the USA police seize cash from people and use it for budget. The system is set up for the benefit of police - budgetary plans are laid, you have no direct recourse to the law because it is the cash that defends itself, the proceeds are carved up.

Maybe this will convince you - if cash seizure by police wasn't a 'thing' we wouldn't need this chart:

June 12, 2015

Issuance of assets, Genesis of transactions, contracting for swaps - all the same stuff

Here's what Greg Maxwell said about asset issuance in sidechains:

So the idea behind the issued assets functionality in Elements is to explicitly tag all of the tokens on the network with an asset type, and this immediately lets you use an efficient payment verification mechanism like bitcoin has today. And then all of the accounting rules can be grouped by asset type. Normally in bitcoin your transaction has to ensure that the sum of the coins that comes in is equal to the sum that come out to prevent inflation. With issued assets, the same is true for the separate assets, such that the sum of the cars that come in is the same as the sum of the cars that come out of the transaction or whatever the asset is. So to issue an asset on the system, you use a new special transaction type, the asset issuance transaction, and the transaction ID from that issuance transaction becomes the tag that traces them around. So this is early work, just the basic infrastructure for it, but there's a lot of neat things to do on top of this. *This is mostly the work of Jorge Tímon*.

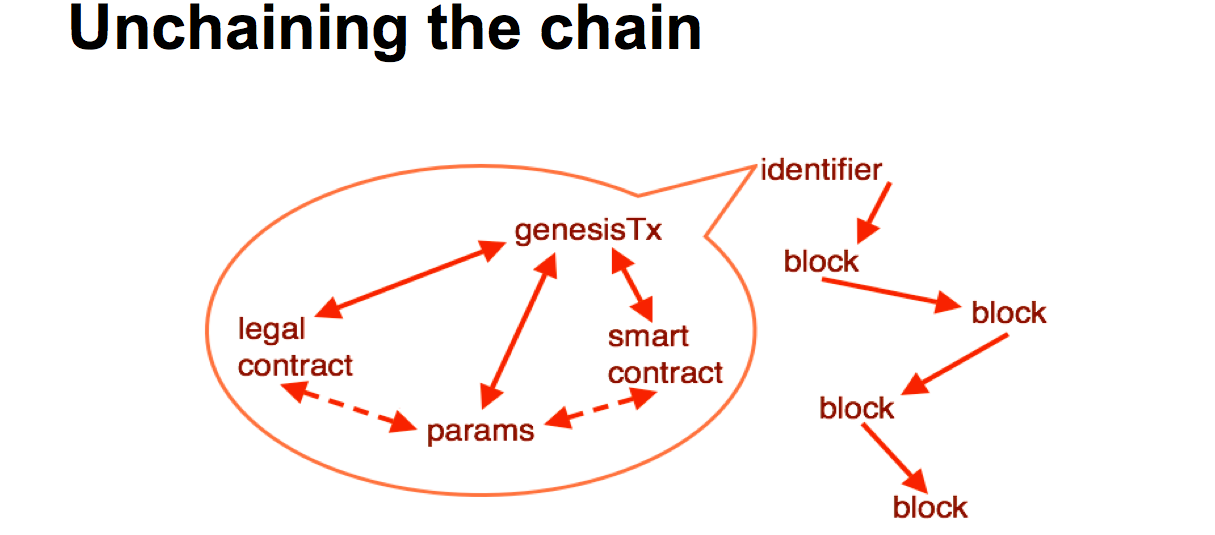

Jorge documented all this back in 2013 in FreiMarkets with Mark Friedenbach. Basically he's adding issuance to the blockchain, which I also covered in principle back in that talk in January at PoW's Tools for the Future. As he covers issuance above, here's what I said about another aspect, being the creation of a new blockchain:

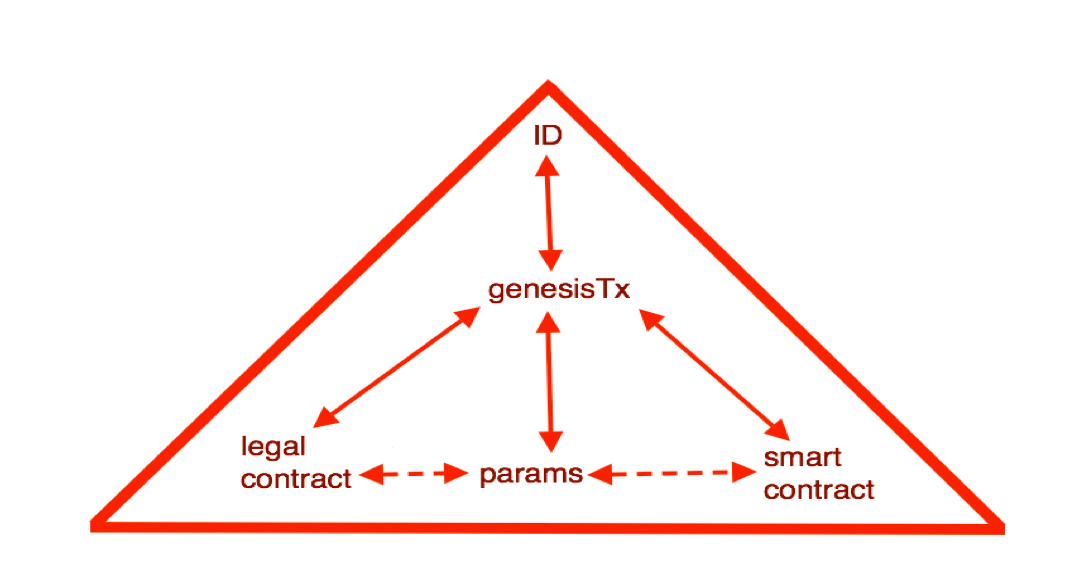

Where is this all going? We need to make some changes. We can look at the blockchain and make a few changes. It sort of works out that if we take the bottom layer, we've got a bunch of parameters from the blockchain, these are hard coded, but they exist. They are in the blockchain software, hard coded into the source code.

So we need to get those parameters out into some form of description if we're going to have hundreds, thousands or millions of block chains. It's probably a good idea to stick a smart contract in there, who's purpose is to start off the blockchain, just for that purposes. And having talked about the legal context, when going into the corporate scenario, we probably need the legal contract -- we're talking text, legal terms and blah blah -- in there and locked in.

We also need an instantiation, we need an event to make it happen, and that is the genesis transaction. Somehow all of these need to be brought together, locked into the genesis transaction, and out the top pops an identifier. That identifier can then be used by the software in various and many ways. Such as getting the particular properties out to deal with that technology, and moving value from one chain to another.

This is a particular picture which is a slight variation that is going on with the current blockchain technology, but it can lead in to the rest of the devices we've talked about.

The title of the talk is "The Sum of all Chains - Let's converge" for a reason. I'm seeing the same thinking in variations go across a bunch of different projects all arriving at the same conclusions.

It's all the same stuff.

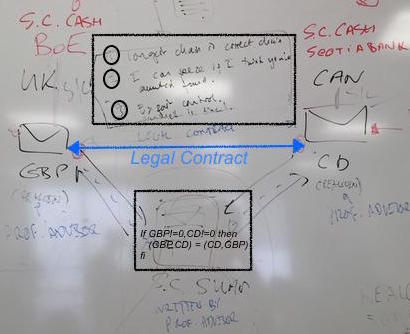

Here's today's "legathon" at UBS, at which the banking chaps tried to figure out how to handle a swap of GBP and Canadian Dollars that goes sour - because of a bug, or a lapse in understanding, or a hack, who knows? The two traders end up in court trying to resolve their difference in views.

In the court, the judge asks for the evidence -- where is the contract? So it was discovered that the two traders had entered into a legal contract that was composed of the prose document (top black box) and the smart contract thingie (lower black box). Then some events had happened, but somehow we hadn't got to the end. At this point there is a deep dive into the tech and the prose and the philosophy, law, religion and anything else people can drag in.

However, there's a shortcut. On that prose on the whiteboard, the lawyer chap who's name escapes me wrote 3 clauses. Clause (1) said:

(1) longest chain is correct chain

See where this is going? The judge now asks which is the longest chain. One side looks happy, the other looks glum.

Let's converge; on the longest chain, *if that's what you wrote down*.

April 03, 2015

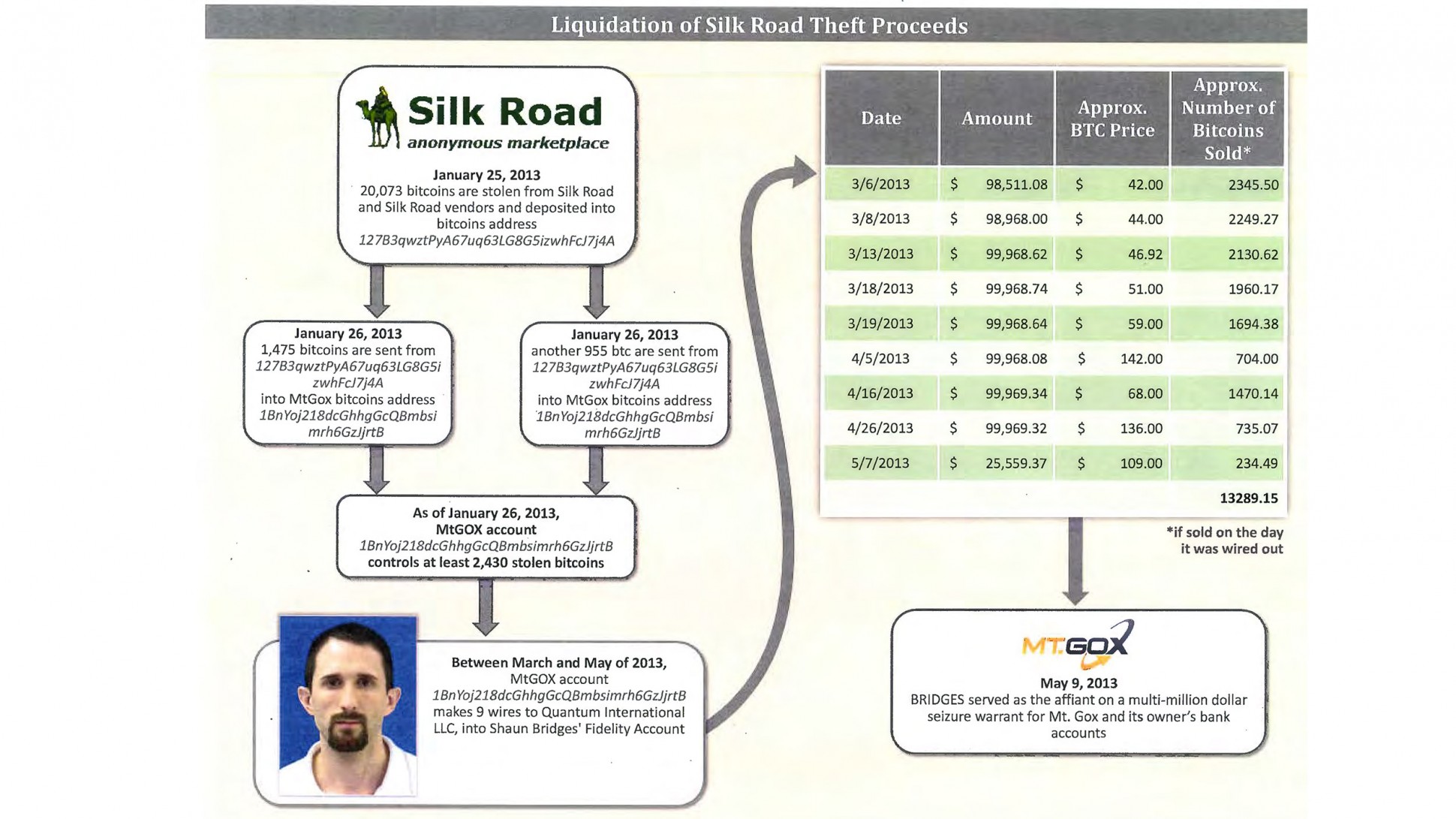

Training Day 2: starring Bridges & Force

Readers might have probably been watching the amazing story of the Bridges & Force arrests in USA. It's starting to look much like a film, and the one I have in mind is this: Training Day.

Readers might have probably been watching the amazing story of the Bridges & Force arrests in USA. It's starting to look much like a film, and the one I have in mind is this: Training Day.

In short: two agents were sent in to bring down the Silk Road website for selling anything (guns, drugs, etc). In the process, the agents stole a lot of the money. And in the process, went on a rampage through the Bitcoin economy robbing, extorting, and manipulating their way to riches.

You can't make this up. Worse, we don't need to. The problem is deep, underlying and demented within our society. We're going to see much more of it, and the reason we know this is that we have decades of experience in other countries outside the OECD purview.

This is our own actions coming back to destroy us. In a nutshell here it is, here is the short story that gets me on the FATF's blacklist and you too if you spread it:

In the 1980s, certain European governments got upset about certain forms of arbitrage across nations by multinationals and rich folk. These people found a ready consensus with others in policing work who said that "follow the money" was how you catch the really bad people, a.k.a. criminals. Between these two groups of public servants they felt they could crack open the bank secrecy that was protecting criminals and rich people alike.

So the Anti Money Laundering or AML project was born, under the aegis of FATF or financial action task force, an office created in Paris under OECD. Their concept was that they put together rules about how to stop bad money moving through the system. In short: know your customer, and make sure their funds were good. Add in risk management and suspicious activity reporting and you're golden.

On passing these laws, every politician faithfully promised it was only for the big stuff, drugs and terrorism, and would never be used against honest or wealthy or innocent people. Honest Injun!

If only so simple. Anyone who knows anything about crime or wealth realises within seconds that this is not going to achieve anything against the criminals or the wealthy. Indeed, it may even make matters worse, because (a) the system is too imperfect to be anything but noise, (b) criminals and wealthy can bypass the system, and (c) criminals can pay for access. Hold onto that thought.

So, if the FATF had stopped there, then AML would have just been a massive cost on society. Westerners would paid basis points for nothing, and it would have just been a tool that shut the poor out of the financial system; something some call the problem of the 'unbanked' but that's a subject for another day (and don't use that term in my presence, thanks!). Criminals would have figured out other methods, etc.

If only. Just. But they went further.

In imposing the FATF 40 recommendations (yes, it got a lot more complicated and detailed, of course) everyone everywhere everytime also stumbled on an ancient truth of bureaucracy without control: we could do more if we had more money! Because of course the society cost of following AML was also hitting the police, implementing this wonderful notion of "follow the money" cost a lot of money.

Until someone had the bright idea: if the money is bad, why can't we seize the bad money and use it to find more bad money?

Until someone had the bright idea: if the money is bad, why can't we seize the bad money and use it to find more bad money?

And so, it came to pass. The centuries-honoured principle of 'consolidated revenue' was destroyed and nobody noticed because "we're stopping bad people." Laws and regs were finagled through to allow money seized from AML operations to be then "shared" across the interested good parties. Typically some goes to the local police, and some to the federal justice. You can imagine the heated discussions about percentage sharing.

What could possibly go wrong?

Now the police were empowered not only to seize vast troves of money, but also keep part of it. In the twinkling of an eye, your local police force was now incentivised to look at the cash pile of everyone in their local society and 'find' a reason to bust. And, as time went on, they built their system to be robust to errors: even if they were wrong, the chances of any comeback were infinitesimal and the take might just be reduced.

AML became a profit center. Why did we let this happen? Several reasons:

1. It's in part because "bad guys have bad money" is such a compelling story that none dare question those who take "bad money from bad guys."

Indeed, money laundering is such a common criminal indictment in USA simply because people assume it's true on the face of it. The crime itself is almost as simple as moving a large pot of money around, which if you understand criminal proceedings, makes no sense at all. How can moving a large pot of money around be proven as ML before you've proven a predicate crime? But so it is.

2. How could we as society be so stupid? It's because the principle of 'consolidated revenue' has been lost in time. The basic principle is simple: *all* monies coming into the state must go to the revenue office. From there they are spent according to the annual budget. This principle is there not only for accountability but to stop the local authorities becoming the bandits The concept goes back all the way to the Magna Carta which was literally and principally about the barons securing the rights to a trial /over arbitrary seizure of their wealth/.

We dropped the ball on AML because we forgot history.

So what's all this to do with Bridges & Force? Well, recall that thought: the serious criminals can buy access. Which of course they've been doing since the beginning, the AML authorities themselves are victims to corruption.

As the various insiders in AML are corrupted, it becomes a corrosive force. Some insiders see people taking bribes and can't prove anything. Of course, these people aren't stupid, these are highly trained agents. Eventually they work out how they can't change anything and the crooks will never be ousted from inside the AML authorities. And they start with a little on the side. A little becomes a lot.

Every agent in these fields is exposed to massive corruption right from the start. It's not as if agents sent into these fields are bad. Quite the reverse, they are good and are made bad. The way AML is constructed it seems impossible that there could be any other result - Quis custodiet ipsos custodes? or Who watches the watchers?

Remember the film Training Day ? Bridges and Force are a remake, a sequel, this time moved a bit further north and with the added sex appeal of a cryptocurrency.

But the important things to realise is that this isn't unusual, it's embedded. AML is fatally corrupted because (a) it can't work anyway, and (b) they breached the principle of consolidated revenue, (c) turned themselves into victims, and then (d) the bad guys.

Until AML itself is unwound, we can't ourselves - society, police, authorities, bitcoiners - get back to the business of fighting the real bad guys. I'd love to talk to anyone about that, but unfortunately the agenda is set. We're screwed as society until we unwind AML.

January 20, 2015

Hitler v. modern western state of the art transit payment systems: Hitler 1, rich white boys 0.

As predicted in the first day we saw it (and published on this blog much later), mass transit payment systems are failing in Kenya:

Payment cards rolling back gains in Kenya's public transport sectorby Bedah Mengo NAIROBI (Xinhua) -- "Cash payment only", reads a sticker in a matatu plying the city center-Lavington route in Nairobi, Kenya. The vehicle belonging to a popular company was among the first to implement the cashless fare payment system that the Kenya government is rooting for.

And as it left the city center to the suburb on Monday, some passengers were ready to pay their fares using payment cards. However, the conductor announced that he would not accept cashless payments.

"Please pay in cash," he said. "We have stopped using the cashless system."When one of the passengers complained, the conductor retorted as he pointed at the sticker pasted on the wall of the minibus. "This is not my vehicle, I only follow orders."

All passengers paid their fares in cash as those who had payment cards complained of having wasted money on the gadgets. The experience in the vehicle displays the fate of the cashless fare payment in the East African nation. The system is fast-fading from the country's transport barely a month after the government made frantic efforts to entrench it. ...

It's probably too late for them now, but I think there are ways to put such a system out through Kenya's mass transit. You just don't do it that way because the market will not accept it. Rejection was totally obvious, and not only because asymmetric payment mechanisms don't succeed if both sides have a choice:

The experience in the vehicle displays the fate of the cashless fare payment in the East African nation. The system is fast-fading from the country's transport barely a month after the government made frantic efforts to entrench it.The Kenya government imposed a December 1, 2014 deadline as the time when all the vehicles in the nation should be using payment cards. A good number of matatu operators installed the system as banks and mobile phone companies launched cards to cash in on the fortune.

Commuters, on the other hand, bought the cards to avoid being inconvenienced. However, the little gains that were made in that period are eroding as matatu operators who had embraced the system go back to the cash.

"We were stopped from using the cashless system, because the management found it cumbersome. They said they were having cash-flow problems due to the bureaucracies involved in getting payments from the bank. None of our fleet now uses the system," explained the conductor.A spot on various routes in the city indicated that there are virtually no vehicles using the cashless system.

"When it failed to take off on December 1 last year, many vehicles that had installed the system abandoned it. They have the gadgets, but they are not using them," said Manuel Mogaka, a matatu operator on the Umoja route.

As I pointed out the root issue they missed here was the incentives of, well, just about everyone on the bus!

If someone is serious about this, I can help, but I take the real cash, not fantasy plastic. I spent some time working the real issues in Kenya, and they have more latent potential waiting to be tapped than just about any country on the planet. Our designs were good, but that's because they were based on helping people with problems they wanted solved and were willing to work to solve.

The ditching of the payment cards means that the Kenya government has a herculean task in implementing the system.

"It is not only us who are uncomfortable with the system, even passengers. Mid December last year, some passengers disembarked from my vehicle when I insisted I was only taking cashless fare. I had to accept cash because passengers were not boarding," said Mogaka.

Not handwavy bureaucratic agendas like "stamp out corruption." Yes, you! Read this on corruption and not this:

Kenya's Cabinet Secretary for Transport and Infrastructure Joseph Kamau said despite the challenges, the system will be implemented fully. He noted that the government will only renew licences of the vehicles that have installed the system.But matatu operators have faulted the directive, noting that it would be pointless to have the system when commuters do not have payment cards.

"Those cards can only work with people who have regular income and are able to budget a certain amount of money for fare every month. But if your income is irregular and low, it cannot work," said George Ogundi, casual laborer who stays in Kayole on the east of Nairobi.Analysts note that the rush in implementing the system has made Kenya's public transport sector a "graveyard" where the cashless payment will be buried.

"The government should have first started with revamping the sector by coming up with a well-organized metropolitan buses like those found in developed world. People would have seen their benefits and embraced cashless fare payment," said Bernard Mwaso of Edell IT Solutions in Nairobi.

(Obviously, if the matatu owners don't install, government resistance will last about a day after the deadline.)

September 03, 2014

Proof of Work made useful -- auctioning off the calculation capacity is just another smart contract

Just got tipped to Andrew Poelstra's faq on ASICs, where he says of Adam Back's Proof of Work system in Bitcoin:

Just got tipped to Andrew Poelstra's faq on ASICs, where he says of Adam Back's Proof of Work system in Bitcoin:

In places where the waste heat is directly useful, the cost of mining is merely the difference between electric heat production and ordinary heat production (here in BC, this would be natural gas). Then electricity is effectively cheap even if not actually cheap.

Which is an interesting remark. If true -- assume we're in Iceland where there is a need for lots of heat -- then Bitcoin mining can be free at the margin. Capital costs remain, but we shouldn't look a gift horse in the mouth?

My view remains, and was from the beginning of BTC when Satoshi proposed his design, that mining is a dead-weight loss to the economy because it turns good electricity into bad waste, heat. And, the capital race adds to that, in that SHA2 mining gear is solely useful for ... Bitcoin mining. Such a design cannot survive in the long run, which is a reflection of Gresham's law, sometimes expressed as the simplistic aphorism of "bad money drives out good."

Now, the good thing about predicting collapse in the long run is that we are never proven wrong, we just have to wait another day ... but as Ben Laurie pointed out somewhere or other, the current incentives encourage the blockchain mining to consume the planet, and that's not another day we want to wait for.

Not a good thing. But if we switch production to some more socially aligned pattern /such as heating/, then likely we could at least shift some of the mining to a cost-neutrality.

Why can't we go further? Why can't we make the information calculated socially useful, and benefit twice? E.g., we can search for SETI, fold some DNA, crack some RSA keys. Andrew has commented on that too, so this is no new idea:

7. What about "useful" proofs-of-work?These are typically bad ideas for all the same reasons that Primecoin is, and also bad for a new reason: from the network's perspective, the purpose of mining is to secure the currency, but from the miner's perspective, the purpose of mining is to gain the block reward. These two motivations complement each other, since a block reward is worth more in a secure currency than in a sham one, so the miner is incentivized to secure the network rather than attacking it.

However, if the miner is motivated not by the block reward, but by some social or scientific purpose related to the proof-of-work evaluation, then these incentives are no longer aligned (and may in fact be opposed, if the miner wants to discourage others from encroaching on his work), weakening the security of the network.

I buy the general gist of the alignments of incentives, but I'm not sure that we've necessarily unaligned things just by specifying some other purpose than calculating a SHA2 to get an answer close to what we already know.

Let's postulate a program that calculates some desirable property. Because that property is of individual benefit only, then some individual can pay for it. Then, the missing link would be to create a program that takes in a certain amount of money, and distributes that to nodes that run it according to some fair algorithm.

What's a program that takes in and holds money, gets calculated by many nodes, and distributes it according to an algorithm? It's Nick Szabo's smart contract distributed over the blockchain. We already know how to do that, in principle, and in practice there are many efforts out there to improve the art. Especially, see Ethereum.

So let's assume a smart contract. Then, the question arises how to get your smart contract accepted as the block calculation for 17:20 on this coming Friday evening? That's a consensus problem. Again, we already know how to do consensus problems. But let's postulate one method: hold a donation auction and simply order these things according to the amount donated. Close the block a day in advance and leave that entire day to work out which is the consensus pick on what happens at 17:20.

So let's assume a smart contract. Then, the question arises how to get your smart contract accepted as the block calculation for 17:20 on this coming Friday evening? That's a consensus problem. Again, we already know how to do consensus problems. But let's postulate one method: hold a donation auction and simply order these things according to the amount donated. Close the block a day in advance and leave that entire day to work out which is the consensus pick on what happens at 17:20.

Didn't get a hit? If your smart contract doesn't participate, then at 17:30 it expires and sends back the money. Try again, put in more money? Or we can imagine a variation where it has a climbing ramp of value. It starts at 10,000 at 17:20 and then adds 100 for each of the next 100 blocks then expires. This then allows an auction crossing, which can be efficient.

An interesting attack here might be that I could code up a smartcontract-block-PoW that has a backdoor, similar to the infamous DUAL_EC random number generator from NIST. But, even if I succeed in coding it up without my obfuscated clause being spotted, the best I can do is pay for it to reach the top of the rankings, then win my own payment back as it runs at 17:20.

With such an attack, I get my cake calculated and I get to eat it too. As far as incentives go to the miner, I'd be better off going to the pub. The result is still at least as good as Andrew's comment, "from the network's perspective, the purpose of mining is to secure the currency."

What about the 'difficulty' factor? Well, this is easy enough to specify, it can be part of the program. The Ethereum people are working on the basis of setting enough 'gas' to pay for the program, so the notion of 'difficulty' is already on the table.

I'm sure there is something I haven't thought of as yet. But it does seem that there is more of a benefit to wring from the mining idea. We have electricity, we have capital, and we have information. Each of those is a potential for a bounty, so as to claw some sense of value back instead of just heating the planet to keep a bunch of libertarians with coins in their pockets. Comments?

July 17, 2014

Casebook for a disaster: google's BebaPay and why it is wrong, wrong, wrong

USA press are starting to poke fun at BebaPay, the google payment system for Kenya's mass transit buses called matatus.

Now the secret's out. BebaPay is a casebook study in how not to do a payment system, but it is still a bit of a challenge to try and show why. This is an effort in as few of my words as I can.

Teaser:

Hitler is a matatu, electric raspberry in color, one of the thousands of minibuses that serve as Nairobi's subway system. ... Hitler has been misbehaving lately, refusing to adopt a new technology that could revolutionize one of East Africa's most lawless and lucrative cash-based industries.Google, which some could argue also has a funny, funny name, has been pushing the new technology: a little green transit card that will replace cash payments and track every transaction on the minibuses, ...

Hitler, owned by someone who hasn't heard of Godwin's Law, is typical of mass transit in Africa. Google wants them to take BebaPay, a smart card (NFC) payments solution, instead of that filthy cash stuff.

Clue:

... owners typically demand from the crews a flat fee for using their buses for the day, the drivers and conductors squeeze every cent they can from passengers by stuffing them in as tightly as possible and getting them to their destination at deadly speed. ... If a cop stops a matatu for speeding or overloading, no problem. The driver just shoves a fistful of Kenyan shillings out the window.

In short: cash-based opportunities for corruption, "kitu kidogo," Swahili for "a little something" means the market will fight it, not adopt it. The players will sabotage it.

The journo spotted it, why didn't google?

The idea to use technology to tackle the matatu problem started on a rainy day a couple of years ago when some executives at Google were staring out their plate-glass windows at the matatus stacked up on Uhuru Highway, watching passengers pay double for a ride (matatus always jack up fares on rainy days). The Google executives said, What about a transit card?

They invented it in a glass fishbowl. It's as if the 'google executives' didn't go for a matatu ride, or if they did, they closed their eyes and prayed for a quick return.

Surely wiser heads warned?

"People thought Google was crazy to go into Kenya's transport sector," said Dorothy Ooko, an executive at Google's 40-person office in Nairobi. "When we first got involved, nobody wanted to touch this."

Why didn't they listen? Or at least try and figure out the market, and enter into positive part of it, not a part that will deliberately and systematically sabotage their every step?

One answer is written on the side of another matatu I saw in Nairobi, literally. Unfortunately I couldn't get my android to camera-mode fast enough, but I believe I have the words memorised:

Unless your name is google, stop acting like you know everything

Please, someone, anyone, send me a snap of it!

(Postscript: Bebapay shuts down.)

July 13, 2014

Clinkle crinkle CLUNK

The shine is off Clinkle, the amazing little app that last year landed 30 million dollars for a demo. What were they thinking, people asked? Apparently we now know, they weren't thinking:

“[Executives] came in thinking, ‘OK, this product is launching soon,’” the former employee explains. “Then they realized the back end is not ready, the front end is not ready, Lucas is re-thinking the design, the architecture is not laid out, there’s no security framework, there’s no fraud detection framework, the bank contract is still being signed, the payment processor still needs a lot of work, and they still haven’t figured out who the credit card processor is going to be. These people got overwhelmed.”

Well, there you have it. For the record, I've never done a demo in those terms. All my tech has always been shown in the raw -- when it shows a payment, it is a payment, it's transactional, secure, crypto all the way down.

Investors take note: financial cryptography doesn't really work with screen-shot style demos, HTML5, Flash whatever your poison. If you're looking at ideas on screen, no matter how beautifully drawn or rendered, you're investing in turtles. All the way down.

Don't go there.

Having said that, it takes a special person to even see the entire architecture of financial cryptography and its 7 layers. Hats off to Lucas Duplan for even coming close to building the demo. We don't know what his secret sauce is, and I'd be suspicious that it's even secret or sauce .... but the man can sell.

If he hooked up with a team that could build FC, he'd be dangerous.

But reality is what it is. Second mistake is to believe that he can do it all; the sad sad truth of the startup world is that the Zuckerberg mythology as so aptly shown in the film _The Social Network_ is a one-off. A rarity proven in the exception. It isn't reality, it isn't likely, and it isn't something we should be fooled by. in practice, it takes a serious amount of knowledge to field an FC product, and Declan should hand over the CEO rule and reduce himself to supporting a bigger team, not directing it.

Before that, however, it seems that we have some more hurdles to get over:

For the first time, all Clinkle employees are finally testing out a basic version of the app and moving money.

Alley-oops! No, I really don't think so. You don't go from "there’s no security framework" to moving money just like that.

How do I know that? Well, the thing is that a model for secure payments is so hard that it basically has to derive from someone who's done this sort of thing before. Otherwise, you're asking for a miracle in the making. None of these things are currently evidenced in Crinkle's publicity, so they almost certainly don't have a model for secure payments.

Therefore, Clinkle employees are testing out opportunities for fraud. The real question is, who picks up the tab when the money gets raided? If it is the back-end processor, that contract won't last a week. If it is the consumer, the reputation will lose its shine, and CLUNK. If it is the investor, the question is likely how long they can last while adding the security on later. Etc.

Better off to invest in a complete tech-business-governance model to begin with, methinks.

April 22, 2014

podcasts on pre-Bitcoin from Bitcoin UK

Bitcoin UK has done two podcasts on the cryptocurrency history before Bitcoin:

These podcasts were done at the same time as my rant as posted on the blog a little while ago, "A very fast history of cryptocurrencies BBTC -- before Bitcoin." Interesting for those that prefer to listen more than read.

April 18, 2014

Shots over the bow -- Haiti joins with USA to open up payments for the people

The separation of payments from banks is accelerating. News from Haiti:

The past year in Haiti has been marked by the slow pace of the earthquake recovery. But the poorest nation in the hemisphere is moving quickly on something else - setting up "mobile money" networks to allow cell phones to serve as debit cards.The systems have the potential to allow Haitians to receive remittances from abroad, send cash to relatives across town or across the country, buy groceries and even pay for a bus ride all with a few taps of their cell phones.

Using phones to handle money payments is something we know works. It works so well that some 35% of the economy in Kenya moves this way (I forget the numbers). It works so well Kenya doesn't care about the banks freezing up the economy any more because they have an alternate system, they have resiliance in payments. It works so well that everyone can do mPesa, even the unbanked, which is most of them, bank accounts costing the same in Kenya as the west.

It works so well that mPesa has been the biggest driver to new bank accounts...

Yet mPesa hasn't been followed around the world. The reason is pretty simple -- regulatory interference. Central banks, I'm looking at you. In Kenya, the mission of "financial inclusion" won the day; in other countries around the world, central banks worked against wealth for the poorest by denying them payments on the mobile.

Is it that drastic? Yes. Were the central banks well-minded? Sure, they thought they were doing the right thing, but they were wrong. Mobile money equals wealth for the poor and there is no way around that fact. Stopping mobile money means taking money from the poor, in the big picture. Everything else is noise.

So when the poorest of the poor -- the Haitian earthquake victims were left in the mud, there were no banks left to serve them (sell them?) and the only way to get value out there turned out to be using the mobile phone.

That included, giving the users free mobile phones.

Can you see an important value point here? The value to society of getting mobile money to the poor is in excess of the price of the mobile phone.

Well, this only happens in poor countries, right? Wrong again. The financial costs that are placed on the poor of every country by the decisions of the central banks are common across all countries. Now comes Walmart, for that very express same reason:

In a move that threatens to upend another piece of the financial services industry, Walmart, the country’s largest retailer, announced on Thursday that it would allow customers to make store-to-store money transfers within the United States at cut-rate fees.This latest offer, aimed largely at lower-income shoppers who often rely on places like check-cashing stores for simple transactions, represents another effort by the giant retailer to carve out a space in territory that once belonged exclusively to traditional banks.

...

Lower-income consumers have been a core demographic for Walmart, but in recent quarters those shoppers have turned increasingly to dollar stores.

...

More than 29 percent of households in the United States did not have a savings account in 2011, and about 10 percent of households did not have a checking account, according to a study sponsored by the Federal Deposit Insurance Corporation. And while alternative financial products give consumers access to services they might otherwise be denied, people who are shut out of the traditional banking system sometimes find themselves paying high fees for transactions as basic as cashing a check.

See the common thread with Bitcoin? Message to central banks: shut the people out, and they will eventually respond. The tide is now turning, and banks and central banks no longer have the credibility they once had to stomp on the poor. The question for the future is, which central banks will break ranks first, and align themselves with their countries and their peoples?

November 19, 2013

Bitcoin and how to integrate it into society

Notwithstanding all the bad news I reported yesterday, Bitcoin moves from strength to strength. It hit $1000 in turbulent trading today -- more in China -- and recently surpassed an exaFLOPS in capacity. It's important to analyse both sides of the coin, so to speak, unless one has resigned ones intellectual fate to being an unremitting fan or unrepentant opponent.

Notwithstanding all the bad news I reported yesterday, Bitcoin moves from strength to strength. It hit $1000 in turbulent trading today -- more in China -- and recently surpassed an exaFLOPS in capacity. It's important to analyse both sides of the coin, so to speak, unless one has resigned ones intellectual fate to being an unremitting fan or unrepentant opponent.

(This essay is written to help me get my thoughts in order for Wednesday's Afrikoin conference, where I'm speaking at a panel on Bitcoin and cryptocurrencies in the African context.)

As an economy, the major problem with Bitcoin is trust. The design of a new money system always lives or dies on whether the end-user can trust the results of a transaction. Technically, we can see that Bitcoin does a single transfer of value from Alice to Bob with some sort of aplomb, but this is not enough to gain the trust of the end-user.

A transaction is generally bi-directional. In this case, Bitcoin moves from Alice to Bob, but something also comes back. And it is in the something coming back that Bitcoin struggles.

Let's talk about classical trust mechanisms so we can get a feel for this. When you walk down the street in a strange town, you know you can walk into a shop and buy things -- engage in a bidirectional trade with some currency. This works because the shop is going to be there tomorrow and the day afterwards -- if the shop rips off its customers, the customers will eventually gang up and destroy the shop. Even if you haven't visited the town before, location is a trust signal, permanence is a trust reinforcer, busy custom is a sign of others' trust.

Likewise, when you deal with greenbacks, you know that at the end of the day, there are 300 million Americans that will take them. And, those 300 million know that at the end of the day, their government will take them back in taxes.

There are many other trust mechanisms; but let's turn back to Bitcoin. What makes trade in it trustworthy? Not a lot. There is no statement of value; this is the same weakness that makes PGP's Web of Trust no more than a curiosity. There is no big brother standing behind it, it doesn't look like a national currency. There is no sense of permanence like a brick&mortar shop, and there have already occurred a hundred or so copycat competitors, many of whom have already folded. It is unlike gold with its ancient history of cross-cultural acceptance. There is no sense of the other person you're dealing with, and indeed there is a designed absence of sense -- the unit is supposed to be psuedonymous, which means you're dealing with a key not a person.

Keys don't make deals, people do.

For trust in Bitcoin, there is only supply and demand, which reduces the unit to the trials and tribulations of the market, with no "underlying" or strength. We have a name for that: speculation, as opposed to investment. Bubbles and Ponzies are other words that are bandied around, with more or less stickiness. Either way, this lack of foundation generally means that Bitcoin is not good for long term trade; you can't price ordinary goods in Bitcoin for example, because the price keeps going up, and down.

So, as a rule of the Bitcoin economy, in participating in bidirectional trades, one has to build ones own trust system in.

As a rather good example, this is exactly what the Silk Road did! Bonds were required of newcomers, and funds were held in escrow until delivery of goods were effected. Silk Road worked, trust was maintain, and deals were done.

At least in its short lifespan, before the trust was irrevocably undermined by the attention of the Feds. It's important to understand that whatever you think about the political or legal questions surrounding the capture of the owner and the closing of the market, its demise is synonymous with, or equivalent to, the end of its offer of trust -- its ability to ensure a safe bidirectional trade.

Fans would say that Bitcoin carefully separates out the trust equation from the payments equation, allowing us to build it later in markets like the Silk Road; opponents would say it is fundamentally untrustworthy, I would prefer to say that trust in Bitcoin is unfinished business.

Fans would say that Bitcoin carefully separates out the trust equation from the payments equation, allowing us to build it later in markets like the Silk Road; opponents would say it is fundamentally untrustworthy, I would prefer to say that trust in Bitcoin is unfinished business.

So how do we finish that which is missing? How do we add the trust back into Bitcoin, or in more accepting terms, how do we augment it with the missing pieces?

One normal trust mechanism that businesses do is an old and boring one: collect the details of who the person is, commonly by looking at their passports/national Ids. There are many pros & cons to this method. For many sectors and trades, it is a waste of money, and an invitation to deception, whereas for others it is a leveraging of the state's identity-trust model, for near-free. And, as we've seen, this method leads to the death of privacy as thousands of marketing businesses and dozens of intelligence agencies aggregate your personal life, starting with your ID.

Bad as identity is, it's worth mentioning because for every finance business that needs to make its peace with a nearby government, this is likely what has to be done, whether they like it or not. It is a trust mechanism, or enough of one for many milder purposes, and it is going to be imposed over Bitcoin to a large extent if & when governments figure out what to do.

Pros and cons! How would we then mitigate the many cons to mass identity collection? What about localised circles of trust -- instead of a global facebook for money, perhaps a google-circles for shared wealth? We could share the information locally in small enough circles such that the trust can be vectored to where it is needed, but there is no necessary or single weakness that can be attacked, that inevitably brings the system down.

This is indeed what I'm doing in my business right now. Building a pure transaction system like Bitcoin (which I called Ricardo) was what I did a long time ago; for many years now I've been building trust systems, which is proving to be far more challenging because people are directly involved in ways that they aren't with mere transactions.

Which leads me to my final point: *Trust is people-centric*. Payment systems aren't, they are transaction-centric. Bitcoin takes this separation to new levels by reducing even the Issuer to a non-person called a block-chain, in a sense it is pushing further and further

Which leads me to my final point: *Trust is people-centric*. Payment systems aren't, they are transaction-centric. Bitcoin takes this separation to new levels by reducing even the Issuer to a non-person called a block-chain, in a sense it is pushing further and further

In contrast, the same process I took in building this trust system, which is now in place, applies both to my Ricardo and to Satoshi's Bitcoin. If you meld a payment system with a trust system, what you get is a working economy. But the challenge is not the payment system, it's definitely the trust system.

Adding Bitcoin to our system then will be fairly easy -- and *worthy of trust*. Which might propose yet another benchmark to Bitcoin. When you hear about us offering Bitcoin, that might signal that there is sufficient demand *in mainstream marketplace* for it. We can do it easily because we have the trust. Watch this space?

November 17, 2013

Bitcoin news -- malware, bots, raids, all as predicted, oh my!

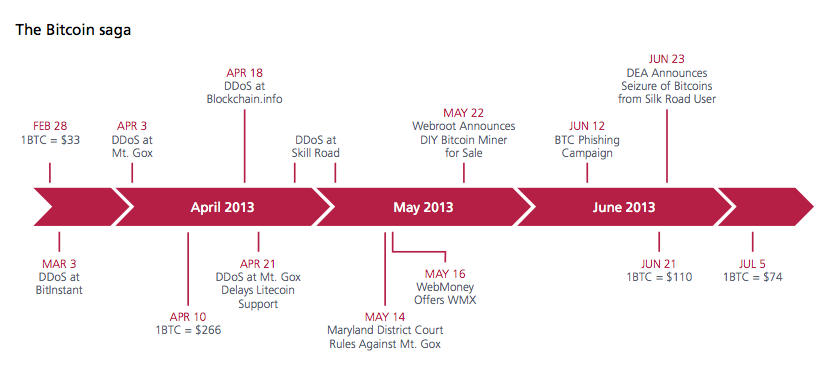

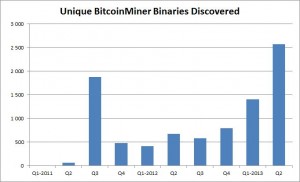

As I'm talking at a conference next week on inter alia matters Bitcoinian, I did a little research on the darker side of the coin. McAfee reports:

As I'm talking at a conference next week on inter alia matters Bitcoinian, I did a little research on the darker side of the coin. McAfee reports:

As the Bitcoin rate has increased, malicious Bitcoin miners have shown a growing interest by infecting victims with malware that uses computer resources to mine Bitcoin without their knowledge. While the cybercriminals generate profits, the computers slow down. In May, for example, Webroot posted a blog about a marketplace to customize and buy such malware.

This is aligned with the article I wrote a year or two back with Philipp Güring, entitled "Bitcoin & Gresham's Law - the economic inevitability of Collapse." The press says more (but I haven't found the source):

"The proliferation of digital currencies fuels the proliferation of tools and services necessary for cybercrime. This in turn helps fuel the growth in cybercrime, and other forms of digital disruption," said McAfee EMEA CTO, Raj Samani."Further, the challenges facing such currencies go beyond their propensity for use within money laundering—to targeted attacks on financial exchanges, and malware developed to target digital wallets."

Evidence that virtual currencies have become a mechanism for online and physical crime risks the possibility of full-scale intervention by governments.

All stirring stuff, and nice to know that we were the first with the right analysis! Don't forget your credits, guys ;-) Ah, found the primary source.

Brian Krebs provides some evidence of that idea that the Botnets would mint some cash:

So far, FeodalCash has managed to attract at least 238 working affiliates. Here is a copy of the affiliate list, complete with their corresponding bitcoin wallets. According to Xylitol, the host PCs that currently have this botcoin mining malware installed are doing their slavish work at the Eligius bitcoin mining pool. According to the FeodalCash administrative panel, the infected machines have mined only about 140 bitcoins. Each bitcoin is currently worth about $100 at today’s exchange rate, making the program’s total haul only about $14,000. The current bitcoin generation rate is about 4.719 bitcoins per day, or about $340.45 daily.

But those numbers are too small to really confirm the hypothesis, and given the FPGA and customized hardware argument, we may never see it (although I reckon we'll see it for GPUs).

Bear in mind when reading this stuff that sales operations like McAfee is in the business of FUD, as that lifts sales of its products. That said, they present a good roundup of the bad things going on:

- Newish exchange Bitinstant was raided by attackers who stole $12k worth. Bitinstant closed.

- Leading exchanger Mt Gox is seeing its new accounts climb "to 75,000 in just the first few days of April."

- Silk Road was closed by the Feds, and they unmasked the Dread Pirate Roberts. They also busted an alleged drugs distributor and took his BTC.

- A court in the US ordered the siezure of Mt Gox's USA funds held by Dwolla.

- WebMoney announced a derivative issue whereby users send them Bitcoins and they receive digital derivative instruments valued 1:1 in BTC.

- Phishers started targetting Bitcoin account holders at Mt Gox.

- Global Bond, a trading platform for bitcoins in China amassed $3.3 million of them, and then the operators ran off with the loot.

- An 18 year old in Australia started a Bitcoin bank and amassed AUD $1.4 million before hackers turned up and taxed the lot.

A long time ago I argued that the only way you knew that a new money was successful was when the crooks started attacking. We've certainly crossed that point now, and by this measure, Bitcoin is successful! Congratulations!

October 29, 2013

Confirmed: the US DoJ will not put the bankers in jail, no matter how deep the fraud

I've often asked the question why no-one went to jail for the frauds of the financial crisis, and now the US government has answered it: they are complicit in the cover-up, which means that the financial rot has infected the Department of Justice as well. Bill Black writes about the recent Bank of America verdict:

I've often asked the question why no-one went to jail for the frauds of the financial crisis, and now the US government has answered it: they are complicit in the cover-up, which means that the financial rot has infected the Department of Justice as well. Bill Black writes about the recent Bank of America verdict:

The author of the most brilliantly comedic statement ever written about the crisis is Landon Thomas, Jr. He does not bury the lead. Everything worth reading is in the first sentence, and it should trigger belly laughs nationwide.

Bank of America, one of the nation’s largest banks, was found liable on Wednesday of having sold defective mortgages, a jury decision that will be seen as a victory for the government in its aggressive effort to hold banks accountable for their role in the housing crisis."

“The government,” as a statement of fact so indisputable that it requires neither citation nor reasoning, has been engaged in an “aggressive effort to hold banks accountable for their role in the housing crisis.” Yes, we have not seen such an aggressive effort since Captain Renault told Rick in the movie Casablanca that he was “shocked” to discover that there was gambling going on (just before being handed his gambling “winnings” which were really a bribe).

There are four clues in the sentence I quoted that indicate that the author knows he’s putting us on, but they are subtle. First, the case was a civil case. “The government’s” “aggressive effort to hold banks accountable” has produced – zero convictions of the elite Wall Street officers and banks whose frauds drove the crisis. Thomas, of course, knows this and his use of the word “aggressive” mocks the Department of Justice (DOJ) propaganda. The jurors found that BoA (through its officers) committed an orgy of fraud in order to enrich those officers. That is a criminal act. Prosecutors who are far from “aggressive” prosecute elite frauds criminally because they know it is essential to deter fraud and safeguard our financial system. The DOJ refused to prosecute the frauds led by senior BoA officers. The journalist’s riff is so funny because he portrays DOJ’s refusal to prosecute frauds led by elite BoA officers as “aggressive.” Show the NYT article to friends you have who are Brits and who claim that Americans are incapable of irony. The article’s lead sentence refutes that claim for all time.

The twin loan origination fraud epidemics (liar’s loans and appraisal fraud) and the epidemic of fraudulent sales of the fraudulently originated mortgages to the secondary market would each – separately – constitute the most destructive frauds in history. These three epidemics of accounting control fraud by loan originators hyper-inflated the real estate bubble and drove our financial crisis and the Great Recession. By way of contrast, the S&L debacle was less than 1/70 the magnitude of fraud and losses than the current crisis, yet we obtained over 1,000 felony convictions in cases DOJ designated as “major.” If DOJ is “aggressive” in this crisis what word would be necessary to describe our approach?

Read on for the details of how Bill Black forms his conclusion.

September 19, 2013

Research on Trust -- the numbers matter

Many systems are built on existing trust relationships, and understanding these is often key to their long term success or failure. For example, the turmoil between OpenPGP and x509/PKI can often be explained by reference to their trust assumptions, by comparing the web-of-trust model (trust each other) to the hierarchical CA model (trust mozilla/microsoft/google...).

In informal money systems such as LETS, barter circles and community currencies, it has often seemed to me that these things work well, or would work well, if they could leverage local trust relationships. But there is a limit.

To express that limit, I used to say that LETS would work well up to maybe 100 people. Beyond that number, fraud will start to undermine the system. To put a finer point on it, I claimed that beyond 1000 people, any system will require an FC approach of some form or other.

Now comes some research that confirms some sense of this intuition, below. I'm not commenting directly on it as yet, because I haven't the time to do more than post it. And I haven't read the paper...

'Money reduces trust' in small groups, study shows

By Melissa Hogenboom Science reporter, BBC News

People were more generous when there was no economic incentive

A new study sheds light on how money affects human behaviour.

Exchanging goods for currency is an age old trusted system for trade. In large groups it fosters co-operation as each party has a measurable payoff.

But within small groups a team found that introducing an incentive makes people less likely to share than they did before. In essence, even an artificial currency reduced their natural generosity.

The study is published in journal PNAS.

When money becomes involved, group dynamics have been known to change. Scientists have now found that even tokens with no monetary value completely changed the way in which people helped each other.

Gabriele Camera of Chapman University, US, who led the study, said that he wanted to investigate co-operation in large societies of strangers, where it is less likely for individuals to help others than in tight-knit communities.

The team devised an experiment where subjects in small and large groups had the option to give gifts in exchange for tokens.

The study

- Participants of between two to 32 individuals were able to help anonymous counterparts by giving them a gift, based solely on trust that the good deed would be returned by another stranger in the future

- In this setting small groups were more likely to help each other than the larger groups

- In the next setting, a token was added as an incentive to exchange goods. The token had no cash value

- Larger groups were more likely to help each other when tokens had been added, but the previous generosity of smaller groups suffered

Social cost

They found that there was a social cost to introducing this incentive. When all tokens were "spent", a potential gift-giver was less likely to help than they had been in a setting where tokens had not yet been introduced.

The same effect was found in smaller groups, who were less generous when there was the option of receiving a token.

"Subjects basically latched on to monetary exchange, and stopped helping unless they received immediate compensation in a form of an intrinsically worthless object [a token].

"Using money does help large societies to achieve larger levels of co-operation than smaller societies, but it does so at a cost of displacing normal of voluntary help that is the bread and butter of smaller societies, in which everyone knows each other," said Prof Camera.

But he said that this negative result was not found in larger anonymous groups of 32, instead co-operation increased with the use of tokens.

"This is exciting because we introduced something that adds nothing to the economy, but it helped participants converge on a behaviour that is more trustworthy."

He added that the study reflected monetary exchange in daily life: "Global interaction expands the set of trade opportunities, but it dilutes the level of information about others' past behaviour. In this sense, one can view tokens in our experiment as a parable for global monetary exchange."

'Self interest'

Sam Bowles, of the Santa Fe Institute, US, who was not involved with the study, specialises in evolutionary co-operation.

He commented that co-operation among self-interested people will always occur on a vast scale when "helping another" consists of exchanging a commodity that can be bought or sold with tokens, for example a shirt.

"The really interesting finding in the study is that tokens change the behavioural foundations of co-operation, from generosity in the absence of the tokens, to self-interest when tokens are present."

"It's striking that once tokens become available, people generally do not help others except in return for a token."

He told BBC news that it was evidence for an already observed phenomenon called "motivational crowding out, where paying an individual to do a task which they had already planned to do free of charge, could lead people to do this less".

However, Prof Bowles said that "most of the goods and services that we need that make our lives possible and beautiful are not like shirts".

"For these things, exchanging tokens could never work, which is why humans would never have become the co-operative species we are unless we had developed ethical and other regarding preferences."

July 28, 2013

I’m Still Waiting for My Phone to Become My Wallet

From the humour department, and for those of us who remember the hype of the 1990s over payments, this article from Jenna Wortham is hilarious:

From the humour department, and for those of us who remember the hype of the 1990s over payments, this article from Jenna Wortham is hilarious:

I’m Still Waiting for My Phone to Become My WalletDURING the sweltering heat wave earlier this month, it seemed too hot to wear much, carry much or do much of anything at all. Every time I left the house, I tried to figure out where to stuff my bulky wallet. I always had room for my iPhone, even if it meant carrying it in my hand. But the wallet was one thing too many.

A truly mobile wallet — one that would let you easily pay for restaurant meals, subway rides or beers at a bar with a quick wave of your cellphone — has long been described as imminent. But it remains elusive. Some innovations have begun to bridge the gap, but most have been a disappointment or have not yet worked well enough for mainstream adoption.

...

September 24, 2012

Gold and Tungsten - a fearful mix

News circulating in the physical gold world is about a rash of lungsten-laced bars being discovered (Germany, UK and USA).

The problem here is multi-faceted. The gold market works on trust, and only brief and cursory checks are made, if you are a trusted player. Taking up the story from WaPo:

Fadl said he did his due diligence “by X-raying the bars to ascertain the purity of the gold and weighing the bars, and the Swiss markings were perfect.”

The problem with this is that if too many people follow the same customary model, it makes the entire market vulnerable to a stuffing operation. Too many people, too much trust means you can always find someone to slide in some well-manufactured fakes.

Fadl became suspicious when he offered the salesman a deep discount for the investment-grade gold bars and he quickly accepted it, a source tells The Post. .... To quell his suspicion, Fadl then drilled into the bar and discovered the tungsten — whose silver color is distinctive from gold’s bright yellow hue.

Oops. As I predicted many years ago, we now have a problem - how to test all the bars in all the vaults? Many of them haven't been touched for decades.

Or have they? No matter. We can always ask the government for help:

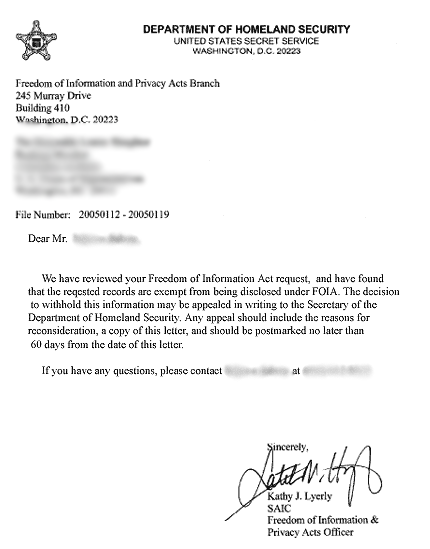

Raymond Nassim, CEO of Manfra, Tordell & Brookes, the American arm of the Swiss firm that created the original gold bars — with their serial number and purity rating stamped clearly into them — said he reported the situation to the US Secret Service, whose jurisdiction covers the counterfeiting of gold bars.He said his company “is supporting and cooperating with authorities any way we can.” .... Numerous calls to the Secret Service were not returned.

(hattip to ZeroHedge for these posts.)

March 16, 2012

Paypal go back to their roots - Paypal Here Again

In what is a development redolent with history, Paypal have developed a way to turn your phone into a credit card register:

Much like Square, PayPal Here will have a card reader that plugs into your mobile phone via the headset jack on your handset. While Square's reader comes in the form of a white square device, PayPal's will instead be a blue triangle. The encrypted reader will be available for free to small business owners and can be used to accept credit card payments. ... While the PayPal Here app is designed to be used hand in hand with the card reader, the app can also be used to accept checks, keep track of cash transactions, and accept credit card transactions in situations where you might not have your card reader present.Credit card and check transactions can be accepted by capturing a photo of the check or card in question, and customers select a tip amount and sign for the transaction directly on the phone's screen.

Much of the post correctly points out that Paypal are playing catchup against Square which does the same thing.

What older readers will find amusing is the sense of deja vu - Paypal was originally an application on a Palmtop. And the use of sound to transmit the credit card information to the phone is also quite evocative of the old days of phone-coupling models.

February 29, 2012

Google thought about issuing a currency

Chris points to:

Google once considered issuing its own currency, to be called Google Bucks, company Chairman Eric Schmidt said on stage in Barcelona at the Mobile World Congress Tuesday.At the end of his keynote speech, Schmidt hit on a wide array of topics in response to audience questions. "We've had various proposals to have our own currency we were going to call Google Bucks," Schmidt said.

The idea was to implement a "peer-to-peer money" system. However, Google discovered that the concept is illegal in most areas, he said. Governments are typically wary of the potential for money laundering with such proposals. "Ultimately we decided we didn't want to get into that because of these issues," Schmidt said.

Offered without too much analysis. This confirms what we suspected - that they looked at it and decided not to. Technically, this is a plausible and expected decision that will be echoed by many conventional companies. I would expect Apple to do this too, and Microsoft know this line very well.

However we need to understand that this result is intentional, the powers that be want you to think this way. Banks want you to play according to their worldview, and they want you to be scared off their patch. Sometimes however they don't tell the whole truth, and as it happens, p2p is not illegal in USA or Europe - the largest markets. You are also going to find surprising friends in just about any third world country.

Still, google did their own homework, and at least they investigated. As a complicated company with many plays, they and they alone must do their strategy. Still, as we move into GFC-2 with the probability of mass bank nationalisations in order to save the payments systems, one wonders how history will perceive their choice.

February 05, 2012

Why did VISA pull the plug and leave the "little people" high and dry?

Clive asks in comments a long time ago (apologies for late reply):

any thoughts to VISA's extraodinarily abrupt behaviour over stopping all ePassport issued VISA cards?( http://m.krebsonsecurity.com/2010/09/visa-blocks-epassporte/ )

Aside from the seamier side (which all financial systems attract) a large number of "little" people used the system to be paid for their legitimate labours (code cutting etc) and VISA appears to have left them high and dry.

Hi Clive,

One comment gives a fairly good impression about what to expect. I'd say this is a fairly typical pattern in alternative payment systems.

Aside from that, let me develop it in a series of viewpoints.

Evolution. It goes more or less this way: Some entrepreneur figures out a way to get a hot money product out there that appears to bypass the conventional channels. This is reasonable, economic, and politically appealing.

(By politically appealing, we might recall that quote about Paypal founders telling all their new staff about the end of government, libertarians to rule the world, boundless new efficiencies, etc.)

For a while, whichever payment system we are talking about, it does well.

A new product that provides a completely new way of doing business will always find a market in those that really need that. This will also include a significant proportion of morally questionable activities, being those that are shut out by conventional channels which have decided to impose the morals. So, both "clean" and "morally questioned" users exist, both, and both of them are contributing their revenues to the wellbeing of the new payment system. (Cases in point are: video, ecommerce websites, cheap telephony, certificates.)

The latter group, which we might call the moral arbitrageurs, have an advantage because their business model generally promises higher margins. They tend to grow faster, and frequently become the major force at many levels in new business models.

Attack. At some point, the arbitrageurs in the system start to do too well, and come to the attention of some authority somewhere. It matters not which one, or which product, or which morals. That authority starts investigating, figures out where the weak parts are, and leans on them. In the case of payment systems, the weak points are generally the finance partners.

Once the leaning starts, the partner pulls out. In the case identified the partner is Visa, but more often it is a partner bank. This brings us up to the point where Clive asks, but why!? Why did the partner pull out and leave the "little people" high and dry?

For the partner, it is a question of straight economics, not morals. Let's look at the economics of the payment partner. It is based on fees, many of them, easily collected, without trouble, because margins are tight. Each of those fees that is then reneged upon, or worse, the principal is lost, results in much higher costs to the facilitator. So each partner can only accept a tiny percentage of failures before it starts losing money.

Hence, an attacker (in this case the authorities) only needs to lean on a small percentage of payments before the entire body of payments is seen as a loss by the facilitator.

There doesn't need to be a proof of a crime, or indeed any evidence. Just the knowledge by the bank that it isn't worth the fees anymore is good enough, as any fee benefit is going to be consumed in compliance overload and risks. Also, the bank (Visa) knows that a lot of the traffic that is shut out of this system will find its way back to the "legit" system one way or another, and therefore, the bank often prefers to see the alternative payment system as competition it would rather destroy, rather than honest trade to be defended.

In the alternative payments market, it doesn't need much pressure to get a partner to walk away.

Enemies. Where it goes wrong, or what is wrong with this entrepreneurial process depends on who you ask (and yes I'm getting to your second question :) If you ask the regulators, these systems are made for money laundering (ML), so shut them down, or else. No discussion possible, there, because the claim of ML always sticks like mud. If we ask the banks, they'll say they are unfair competition, as the newcomers don't have to pay the regulatory toll (which the incumbents argued successfully for), and the nasty cheap competitors are too cheap. Shut 'em down, yesterday, already! No interest in negotiation.

On the plus side, if we ask the operators, they will say that the system is fair, adults are entitled to play adult games, and real competition is what consumers deserve. They might also point to their safeguards. Nobody ever asks the consumers, and there is little benefit in asking the suppliers of whichever questioned goods we are offended by :)

All these things are likely true at some level (and false at other levels), so which is which and which are correct or false or relevant or specious tends to be irrelevant, because they can all be used. And often are. The alternative payment system lives in a very aggressive world, they have too many enemies.

Addiction. But, I have a different perspective. If you ask me, I'd say it is because the operators got a little too addicted to the morally questionable business. They should have been smarter, avoided the addiction, and eased themselves off it before the habit turned nasty.

Where, both how much and which drug are defined by their circumstances. As I'm most familiar with the story of gold payment systems, a decade or so back, let me outline that one by way of example, but please also note that the evidence published by Paypal reveals the same forces.

The gold community's morally questionable friends were the ponzi schemes and fast-moving payments games, which on the strength of fees income, took the e-gold business into the black, early 2000. This was around 9 months after the first games (aka ponzis) turned up above the radar, so quite a stunning result. I'd also mention that e-gold wasn't the only one, there were others on all sides of the tracks, but e-gold was the leading indicator, the case study.

At that point (strategically speaking, says I), as they entered the black, they should have shifted strategy to increase other "cleaner" opportunities, and reduced the impact of the arbitrage games/schemes. Instead, it could be said that they seemed to chose to defend the adults in their right to participate in these things. Two things are worth noting. This is the libertarian view, which is quite popular in arbitrage sectors, so e-gold's customers were happy. Secondly, adults do have a right, at some fundamental level to lose all their money. But they also seem to like going crying to regulators after enjoying their right to unregulated carnage. And crybabies punch above libertarians at about 100:1 (take note Ron Paul).

Hence, the pattern is somewhat inevitable. For the gold sector, the steamroller started moving by end of 2002, and within 5-6 years, a lot of players were shut down.

Now, with that in context, your real question was this: why did all these honest people lose their money? Why so sudden? Why so immediate?

I think the answer to that is found in the world views of the players. The Feds/banks have already decided that (a) the system is illegal, or quasi-illegal, and, the people using it are either (i) outright crims, (ii) engaging in immoral or quasi-illegal behaviour, or (iii) should have known better than to associate... Further, it will be an internalised truth for the investigators and the banks that, if there are any honest people, they will come forward and prove a claim to the money. "If you've done nothing wrong, you have nothing to hide."

Some of this is true. There were criminals using those gold payment systems, and it was bad stuff. I don't tend to write about it because (a) I lack strong evidence, and (b) people simply don't believe it when I tell them. "Yadda, more conspiracy talk..." It was bad stuff.

That said, it is also true that not all users are tarred with the same brush. The crims are a minority. Many of the users are honest, and they will still lose. Big time. Here's why, on the demand side:

- Not all will those honest people will come forward (because they are scared),

- not all people will be able to prove their claims (because the case is already stacked against them),

- some of them will have questionable behaviour of other forms, and worry about collateral damage,

- many of the holdings will be in the order of under $10k and therefore uneconomic to fight, and

- many of the people concerned will not have enough money to pay for legal help (especially those that lost a lot of their money!).