March 19, 2013

Bank Holiday in Cyprus

It's official - there is a Bank Holiday in Cyprus:

It's official - there is a Bank Holiday in Cyprus:

Cypriots woke up on March 16 to find bank transfers frozen as the country's authorities prepared to remove the tax from accounts before banks were scheduled to reopen on March 19. The Cypriot central bank has since declared bank holidays until March 21 to avert the prospect of account-holders withdrawing all their savings.

The economics term 'bank holiday' is historically synonymous with the banking system being bankrupt, at least.

Meanwhile, the European Finance Ministers have held strong on the need for Cyprus to raise the cash, but left open flexibility in just who for the Cypriots.

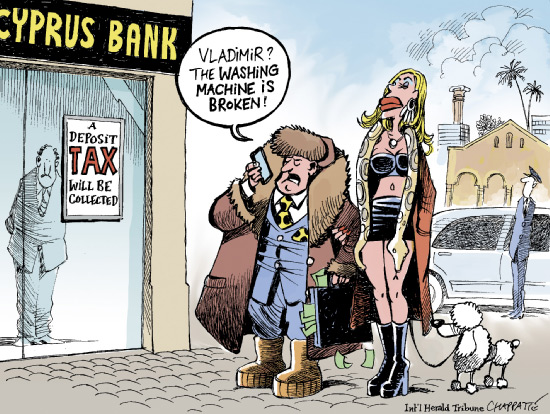

What a dilemma! The obvious answer is "just deposits over 100k" but that will cause massive withdrawals of those same massive deposits from the massive Russian Oligarchs, and put the banking sector into crisis as its revenues and profits are pretty much dependent on those things. (e.g.) The more subtle answer is they have to move broader afield ... and hit the bond holders.

Which will not please the Europeans. Why not? Same reason different channel: the bond holders are the European banks. And the root asset failure of the banking sector is that they are all left holding each others' junk bonds. Wipe out a class of bonds anywhere, and contagion is an issue.

The Europeans have fought to keep the bonds good, but it is an open question how long the game of Russian Roulette goes on. This is exactly how Cyprus got into this mess in the first place: Greek bonds. Which, as all who have studied real banking (a.k.a. free banking) know well, points to the root cause of most banking crises: state intervention in the quality of banking reserves:

One of the US's major criticisms of IFRS (International Financial Reporting Standards) is that it is subject to political intervention.They're right to be concerned, said Mr Andrew. "We had regulators and governments telling us not to write down Greek debt in certain countries. They were refusing to allow accounting firms to adjust, saying they would underwrite a portion of the debt but refusing to put [that commitment] in writing," he said.

In short, banks are required to list state bonds as risk-free. When they are not. Cyprus is one step closer to leaving the euro zone, and declaring default on its bonds. Like Iceland.

Posted by iang at March 19, 2013 02:06 AM | TrackBackWhen You Weren't Looking, Democrat Bank Stooges Launch Bills to Permit Bailouts, Deregulate Derivatives

http://www.nakedcapitalism.com/2013/03/when-you-werent-looking-democrat-bank-stooges-launch-bills-to-permit-bailouts-deregulate-derivatives.html

In the US, depositors have actually been put in a worse position than Cyprus deposit-holders, at least if they are at the big banks that play in the derivatives casino. The regulators have turned a blind eye as banks use their depositaries to fund derivatives exposures. And as bad as that is, the depositors, unlike their Cypriot confreres, aren't even senior creditors. Remember Lehman? When the investment bank failed, unsecured creditors (and remember, depositors are unsecured creditors) got eight cents on the dollar. One big reason was that derivatives counterparties require collateral for any exposures, meaning they are secured creditors. The 2005 bankruptcy reforms made derivatives counterparties senior to unsecured lenders. Lehman had only two itty bitty banking subsidiaries, and to my knowledge, was not gathering retail deposits. But as readers may recall, Bank of America moved most of its derivatives from its Merrill Lynch operation its depositary in late 2011.

... snip ...

and move of derivatives to FDIC insurance

US Deposits In Perspective: $25 Billion In Insurance, $9,283 Billion In Deposits; $297,514 Billion In Derivatives

http://www.zerohedge.com/news/2013-03-19/us-deposits-perspective-25-billion-insurance-9283-billion-deposits-297514-billion-de

other recent

Gaming the Cyprus Negotiations (Updated)

http://www.nakedcapitalism.com/2013/03/gaming-the-cyprus-negotiations.html

Will Cyprus Become Creditanstalt 2.0?

http://www.nakedcapitalism.com/2013/03/will-cyprus-become-creditanstalt-2-0.html

Cyprus: The Next Blunder

http://www.nakedcapitalism.com/2013/03/cyprus-the-next-blunder.html